On the lookout for an trustworthy Security Wing Overview?

On this article, I’ll share with you the ins and outs of utilizing Security Wing, together with what we love about them and what we don’t.

I may also offer you a run down on SafetyWing’s newest product, Nomad Well being which is medical insurance for digital nomads / distant staff.

For those who’re a long-term traveler or digital nomad, bearing the burden of medical prices on the highway is sure to be one among your prime considerations.

Even when you’ve got medical insurance at residence, there are limitations to your protection overseas, which implies hefty out-of-pocket funds, uncommon direct billing, and the likelihood that you could be not be coated in any respect.

These considerations are severe, and makes having journey medical insurance so necessary. That’s why corporations like SafetyWing have created a journey medical insurance coverage for long-term adventurers and digital nomads alike.

Why You Want Journey Medical Insurance coverage

For the typical traveler, journey insurance coverage usually offers enough protection.

Any such insurance coverage covers issues like journey cancellation, misplaced baggage, and different technical incidents which will occur whereas touring. In addition to protecting your monetary funding within the journey, it additionally covers any medical emergencies which will occur alongside the best way.

However, medical insurance coverage primarily covers medical bills, not solely restricted to emergencies. As an example, you may be coated for room and board in a hospital, surgical procedure prices, intensive care prices, and ambulance fees, amongst different related medical bills.

Whereas normal journey insurance coverage is useful, it doesn’t fairly meet the wants of long-term vacationers and digital nomads.

For one, normal journey insurance coverage has limitations equivalent to journey size and the medical protection they do present is geared primarily in the direction of emergencies. Plus, you’re usually not eligible to purchase journey insurance coverage when you’ve left your property nation.

If you’re overseas for a very long time, there’ll seemingly be an occasion or two the place you’ll have to see a health care provider or might even find yourself staying in a hospital for an extended time frame.

These kinds of incidents could be extraordinarily pricey and since they aren’t coated beneath journey insurance coverage, corporations like World Nomads and SafetyWing got here to life.

These corporations have created a hybrid of journey insurance coverage and typical medical insurance, offering protection to long-term vacationers and digital nomads to make sure that they’re adequately offered for overseas in case medical care is required.

✨The 1 Factor We By no means Depart Residence With out…✨

Coming from somebody who has been touring the world for the final 8 years AND has been within the hospital 2x, journey insurance coverage is one thing everybody NEEDS to get. Get a quote under!

SafetyWing: Medical Protection for Lengthy-Time period Vacationers and Digital Nomads

For those who’re a long-term traveler or digital nomad, medical insurance coverage is a should. Accidents occur and also you by no means know when catastrophe will strike, so it’s a lot better to be secure than sorry.

As long-term vacationers ourselves, we’ve had our justifiable share of journey mishaps, and with out medical insurance coverage, we’d have needed to pay 1000’s of {dollars} out of pocket.

What traveler has that form of cash?

That’s why it’s price investing in journey medical insurance coverage like SafetyWing, which was designed particularly with folks like us (and also you) in thoughts.

SafetyWing takes the monetary stress out of significant diseases and accidents overseas, and makes certain you’re coated for unexpected incidents that might occur alongside the best way.

Does SafetyWing Cowl Covid-19?

On the lookout for the most effective journey insurance coverage proper now?

One of many explanation why we love SafetyWing is because of the truth that they had been one of many first insurance coverage insurance policies to cowl Covid-19 after the pandemic began.

Though it isn’t equivalent to enormous concern anymore, SafetyWing nonetheless covers Covid-19 associated diseases.

Do observe that SafetyWing will solely cowl the price of Covid assessments in the event that they’re deemed medically vital. This excludes the antibody assessments.

That being stated, we all know individuals who have gotten repatriation flights and different Covid-19 associated mishaps coated by SafetyWing not too long ago, making them the apparent selection if you happen to’re searching for journey insurance coverage now or any time within the close to future.

Psst…Need in on a Secret? 🤫

We have scoured the web for the most effective ALL-AROUND journey shoe and Tropicfeel wins by far. We have taken ours via rivers, jungles, and cities they usually’re nonetheless alive and kickin’. Examine them out under.

How SafetyWing Works?

As a companion of WorldTrips, subsidiary of insurance coverage large Tokio Marine, SafetyWing provides vacationers insurance coverage that’s a mix of medical and travel-related protection.

You pay $45.08 for 4 weeks of protection if you happen to’re between 18 and 39 years previous, and the premium will increase in accordance with age band if you happen to’re older.

Protection can also be costlier if you happen to’re touring in the US, so maintain that in thoughts when signing up.

Protection robotically renews each 4 weeks for 364 days, and you may cancel at any time (such a luxurious!) with out penalty.

You’ll be able to enroll from anyplace, whether or not you’re nonetheless at residence or already on the highway, so if you happen to’re searching for some protection on the go, SafetyWing is an effective choice.

If you end up needing a health care provider, you possibly can go to any licensed doctor – public or personal.

You’ll be able to attain out if you would like ideas for beneficial physicians in your space. Positively attain out for advance billing if you happen to discover you’re inpatient at hospital, or needing surgical procedure.

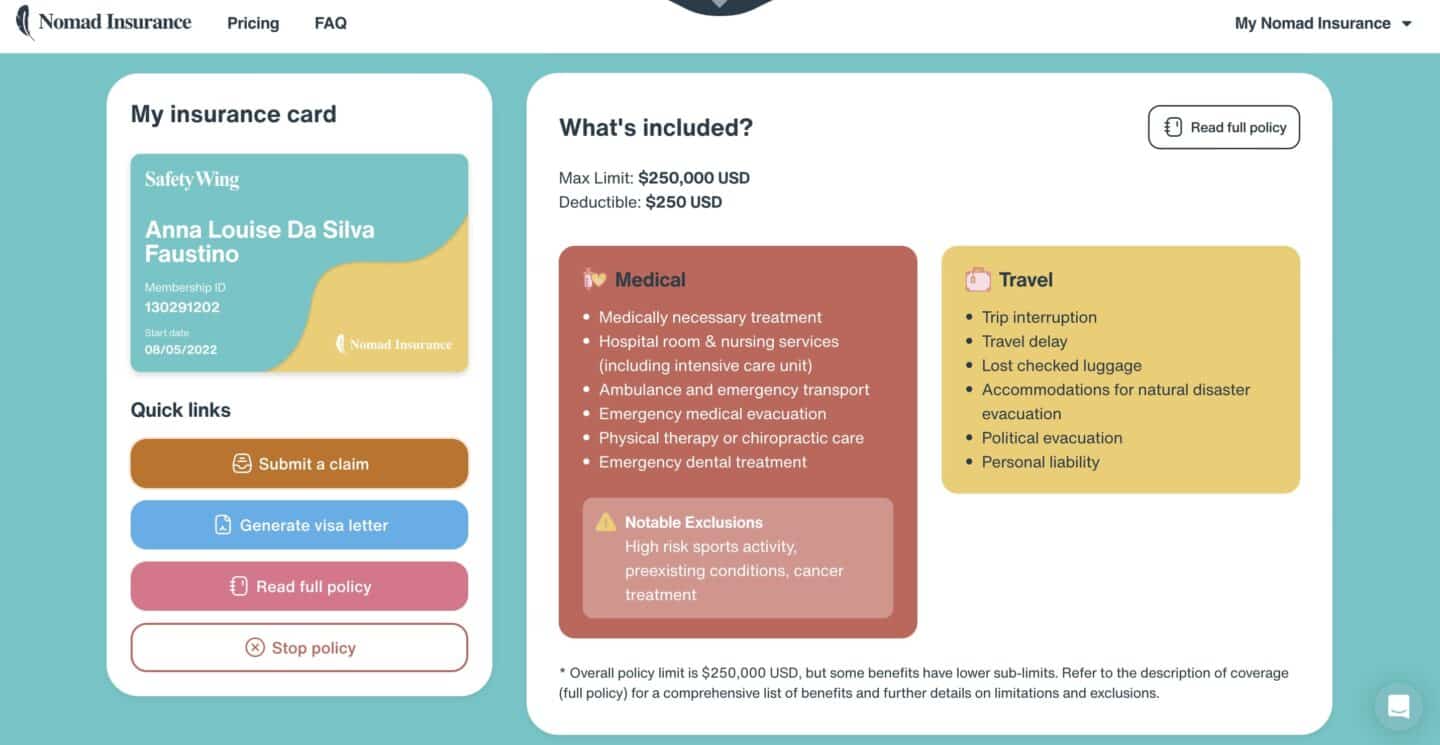

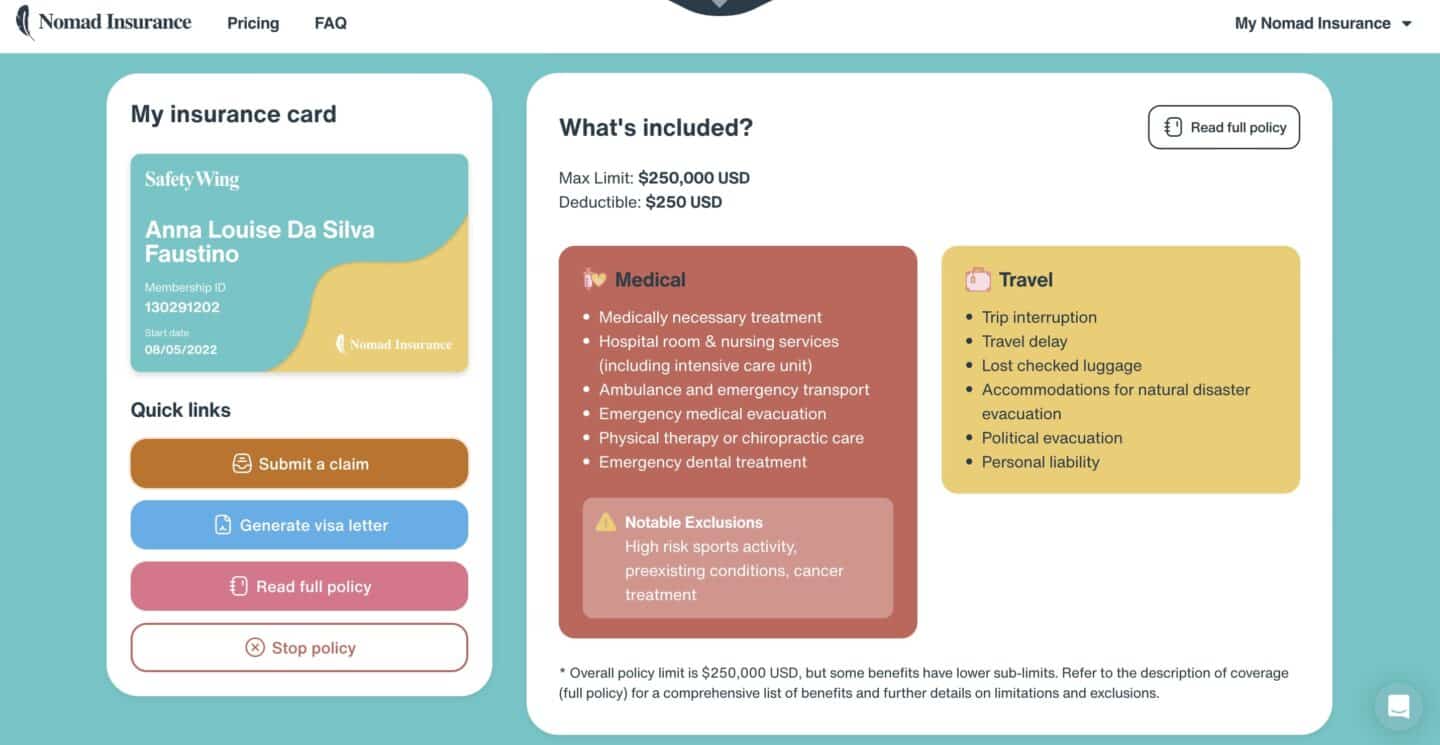

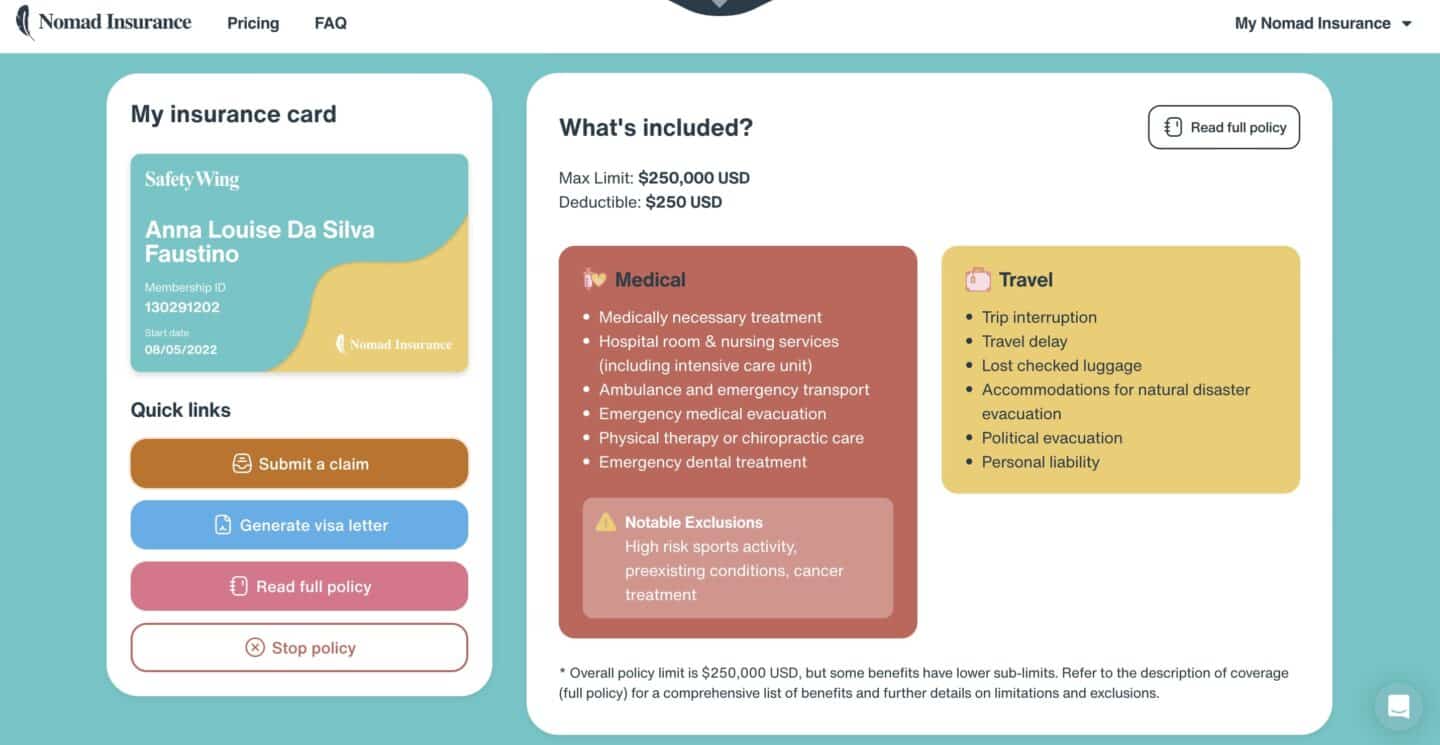

The deductible on SafetyWing is $250 per coverage interval.

SafetyWing: What’s Coated

SafetyWing offers fairly in depth protection, significantly for sudden sickness or harm. Meaning if one thing occurs alongside the best way and also you want medical consideration, SafetyWing has you coated.

Listed below are some key inclusions which can be of curiosity to long-term vacationers or digital nomads:

- Emergency Medical Remedy

- Medical Bills

- Emergency Dental

- Hospital Room and Board

- Member of the family transportation from residence nation within the occasion that you’ve an prolonged hospital keep

- Terrorism Evacuation

- Emergency Medical Evacuation

- Pure Catastrophe Lodging

- Misplaced Checked Baggage

- Journey Interruption

- Journey Delay

Journey Insurance coverage Highlights:

Journey interruption As much as $5,000. No deductible

Journey delay As much as $100 a day after a 12-hour delay interval requiring an unplanned in a single day keep. Topic to a most of two days. No deductible

Misplaced checked baggage As much as $3,000 per certificates interval; $500 per merchandise. As much as $6,000 lifetime restrict. No deductible.

Pure catastrophe — a brand new place to remain As much as $100 a day for five days. No deductible

Political evacuation As much as $10,000 lifetime most. Not topic to deductible

Emergency medical evacuation As much as $100,000 lifetime most. Not topic to deductible or general most restrict.

Medical Insurance coverage highlights:

Max Restrict $250,000 ($100,000 for 65-69 years previous)

Deductible $250

Hospital Room and nursing providers

Intensive care As much as the general most restrict

Ambulance Traditional, affordable and customary fees when coated sickness or harm leads to hospitalization

Bodily remedy and chiropractic care As much as $50 per day. Have to be ordered upfront by a doctor.

Emergency dental As much as $1000, should obtain preliminary remedy inside 72 hours (24 hours if coverage was bought previous to February 1, 2023, not topic to deductible.

All Different Eligible Medical Bills As much as the general most restrict.

What’s Not Coated

Like most insurance coverage insurance policies, there are particular issues that aren’t coated beneath SafetyWing. These exclusions are routine check-ups, pre-existing situations, and most cancers remedy, which is fairly affordable as that is journey medical insurance coverage, not main medical insurance.

If medical insurance is what you’re after, take a look at the part under on Nomad Well being.

Replace: Security Wing’s newest coverage covers a WIDE number of sports activities from scuba diving, bungee leaping and extra. Try their full coverage under.

Lastly, SafetyWing additionally gained’t cowl journey cancellations. For full particulars on what’s coated (and never coated) in a SafetyWing coverage, we advocate testing their web site.

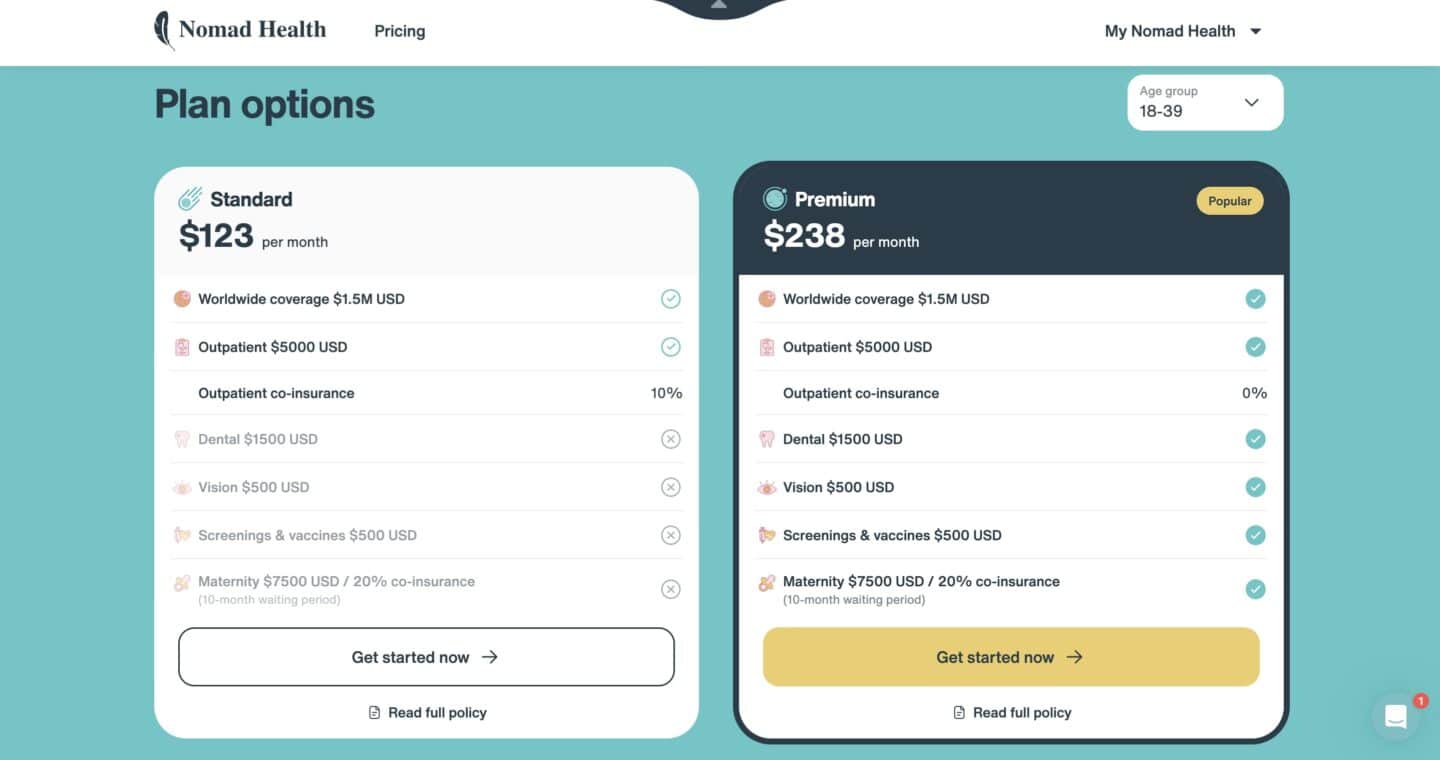

Nomad Well being Overview

As talked about, the coverage that I primarily discuss right here is SafetyWing’s journey insurance coverage. They not too long ago launched Nomad Health which is medical insurance primarily for distant staff.

So what precisely is Nomad Well being? It’s a World medical insurance for distant staff and nomads that covers your medical wants worldwide, together with in your house nation.

With Nomad Well being, you’re coated in 175+ nations, and may get handled by any licensed skilled at any clinic or hospital, personal or public.

Please observe that protection for US, SG, and HK are solely legitimate for 30 days when touring there.

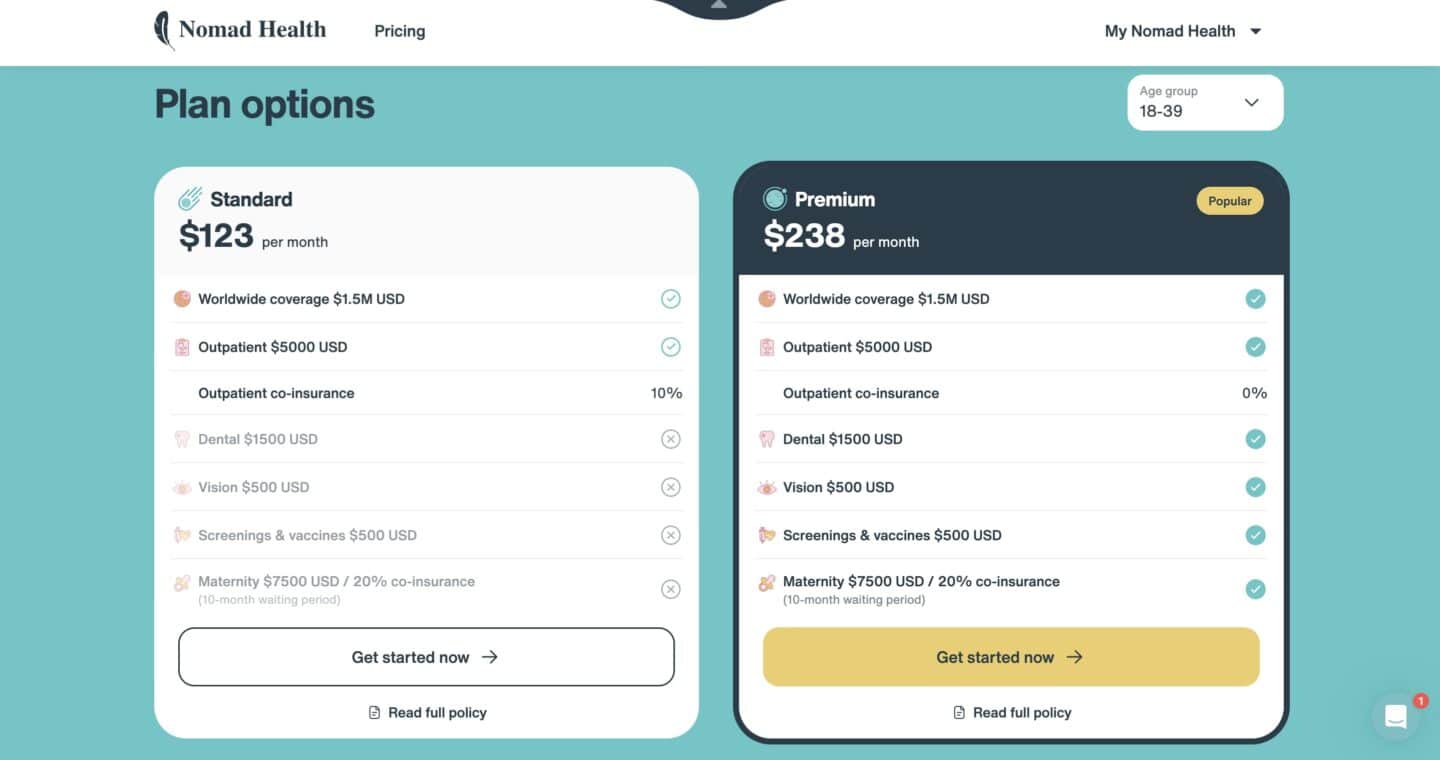

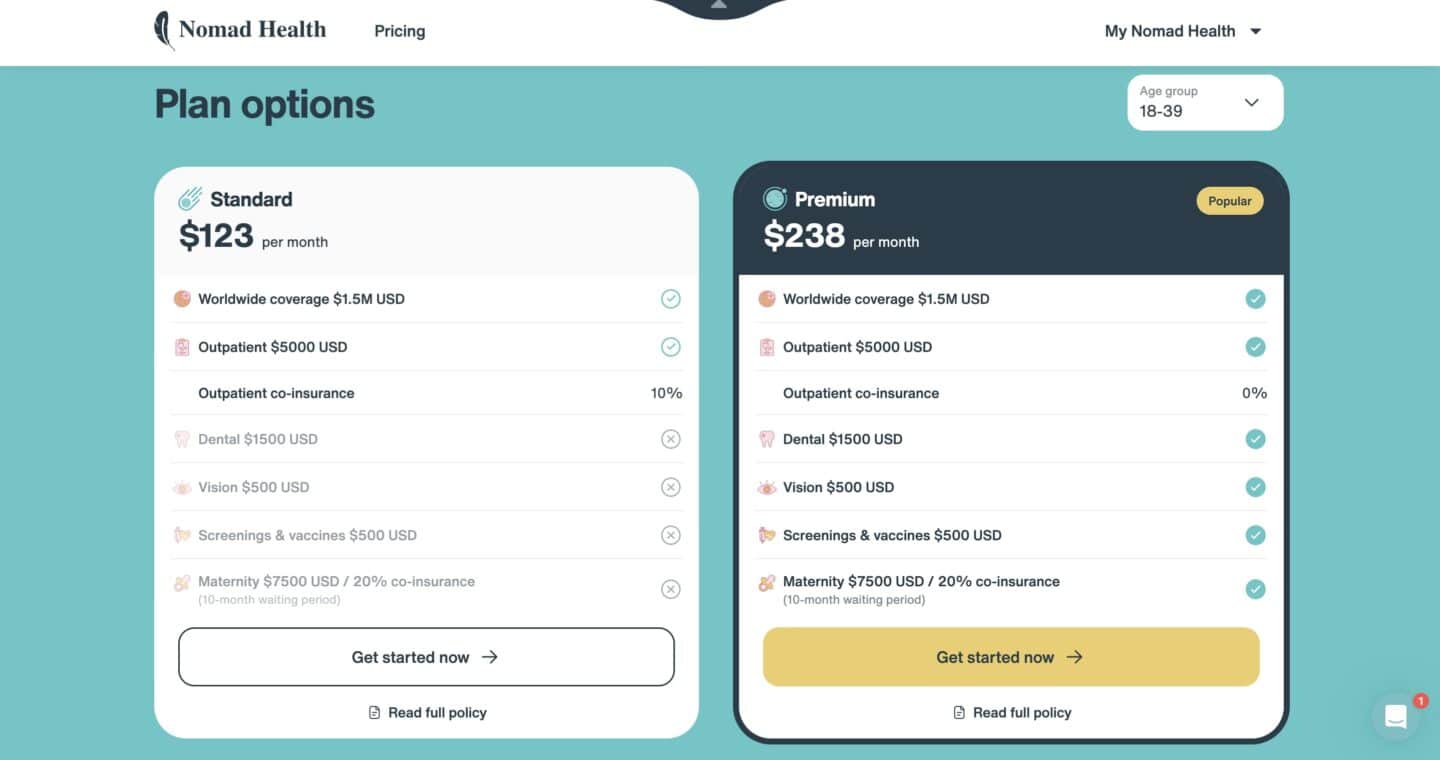

Right here’s a fast overview of the 2 coverage plans that Nomad Well being provides.

What Nomad Well being Covers

In a nutshell, Nomad Health covers all the things {that a} common medical insurance covers, besides it is a coverage, made particularly for nomads who transfer round completely different areas all 12 months spherical.

The utmost protection is US$1,500,000 per coverage 12 months and 100% covers inpatient prices like commonplace personal rooms, ICU, emergency room care, prescription drugs, most cancers assessments,

medicine and coverings and extra.

The utmost allowable quantity for all mixed outpatient US$5,000 profit bills is as much as 5 thousand {dollars} (US$5,000) per Coverage 12 months. A ten p.c (10%) co-insurance cost applies for all Outpatient providers.

This contains doctor visits, medicine, bodily remedy and extra.

General, I’m fairly impressed with the protection they’re providing as most well being insurances we’ve discovered are tied to geographical areas.

If you take out a Nomad Well being coverage, you possibly can add dependents (partner / kids) which will increase your premium relying on what number of you add on.

For a full listing of what’s coated within the coverage, I like to recommend testing the hyperlink under!

Private Expertise With SafetyWing

Our expertise with SafetyWing has been overwhelmingly constructive thus far!

We had been trying to check out a brand new insurance coverage supplier, and have been actually happy with the expertise. We haven’t run into issues, and discover that navigating their web site and processes have been very simple.

We not too long ago filed a dental declare with Security Wing and promptly obtained the cost again, following the file process for emergency dental claims.

What We Like about Security Wing

Not solely does SafetyWing present protection that fits our wants, it’s additionally simple to make use of with an excellent platform that makes getting began very easy.

We actually like the choice to make funds each 4 weeks, with the choice to cancel at any time. Having no long-term, set in stone contract is tremendous helpful, particularly for these simply enthusiastic about making an attempt it out or folks touring for a brief time period.

Personally, I LOVE the truth that it is a month-to-month dedication reasonably than a yearly one. This makes it much more manageable financially in addition to flexibility clever.

The subscription mannequin can also be tremendous interesting for long-term vacationers who don’t know when their globetrotting shall be coming to an finish.

This lets you keep coated for your entire time you’re overseas, with out having to fret about falling beneath a sure plan or set timeframe.

You are also coated for 30 days in your property nation for each 90 days of protection overseas (15 days, if you happen to’re a U.S. citizen).

We additionally actually like how simple it’s to grasp SafetyWing’s insurance policies and all that’s coated. The coverage breakdowns on the web site are easy and straightforward to grasp, with out all of the insurance coverage jargon that’s typically included with this data.

For those who’re enthusiastic about looking on the full coverage, that’s offered as effectively, however we like having a information to grasp what we’re getting.

As a result of it’s accessible for buy in 180 nations and you should purchase protection even if you’re already overseas, SafetyWing could be very interesting for individuals who could also be missing insurance coverage however already out on their adventures (like me!).

You don’t even want proof of residency in your house nation, or anyplace else for that matter, making signing up and receiving protection extraordinarily simple and hassle-free.

Lastly, SafetyWing covers quite a bit at a low worth.

A premium of $45.08 each 4 weeks is an extremely affordable deal and less expensive than the alternate options on the market, making it an interesting choice for digital nomads and full-time vacationers like us!

This worth is one thing we actually love about this supplier, and is an effective incentive to resume our protection.

The Claims Course of for Security Wing

The claims course of is simple, which is one more reason why we love these guys.

To start out, you simply go online to your SafetyWing account and click on sumbit a declare. This can take you to a Docusign kind which you need to full.

If you hit submit, you’ll obtain a affirmation electronic mail instantly from Docusign. You’ll be able to then go to WorldTrip’s Member Portal to catch updates in your declare.

It’s good to learn all through the entire course of as an alternative of simply being notified when your declare is both accepted or rejected.

Security Wing Buyer Service

One other factor that we actually like is about Security Wing is their buyer help.

They’re VERY simple to contact and at all times have somebody on standby to get again to us. Earlier than I head to the physician, I normally attain out to their customer support to ask what I would want in that particular occasion to make a declare.

This can permit me to recollect all the things I would like previous to leaving my appointment.

Fortunately, we’ve by no means truly needed to declare something with Security Wing. We had inquired about presumably submitting for a dental remedy however received clarification from their customer support that our remedy didn’t qualify beneath the emergency dentist clause.

Nonetheless, now we have had A LOT of pals who used them when Covid19 first broke out who received full repatriation flights coated again to their residence nations from varied elements of the world.

FAQ on SafetyWing Insurance coverage

YES, SafetyWing is a legit insurance coverage firm which operates beneath Tokio Marine HCC. We personally use them and love the benefit of use / availability of month-to-month funds

If you get SafetyWing protection, you might be coated for journey anyplace on the earth outdoors of your property nation, except *Cuba, Iran, Syria, and North Korea. You might be solely coated in your house nation for 30 days and 15 days if you happen to’re from the US.

Whereas some insurance coverage suppliers require you to get insurance coverage whilst you’re in your house nation, you may get SafetyWing protection wherever you might be. This makes it best for frequent vacationers and digital nomads.

The beauty of SafetyWing is that it really works the identical as another sickness so long as it was not contracted earlier than your protection begin date, and doesn’t fall beneath another coverage exclusion or limitation.

Make observe that Testing for COVID-19 will solely be coated if deemed medically vital by a doctor. The antibody check will not be coated, as it isn’t medically vital.

In case you have the Nomad insurance coverage, quarantine is now additionally coated outdoors your property nation of $50/day for as much as 10 days (with the limitation of being as soon as inside a 364-day interval)

When you get protection, you possibly can file a declare by filling out a claims kind, and importing it along with images or screenshots of receipts to WorldTrips’ on-line portal. We advocate documenting EVERYTHING on the subject of insurance coverage claims. Whereas the claiming course of is kind of tedious (we’ve discovered this true for ALL insurance coverage suppliers).

es, so long as the accident doesn’t fall beneath any exclusions, such because the exclusions for racing and intoxication. Don’t drink and drive, pals!

Our General Ideas on Security Wing

For those who’re a long-term traveler or digital nomad, it is best to completely think about SafetyWing as your insurance coverage supplier. Their easy, cheap, and widely-covered insurance coverage will make our lives that a lot safer and simpler anyplace on the earth.

The one vacationers I wouldn’t advocate SafetyWing to are those that continually take part in journey sports activities or transfer round with a lot of costly gear, as these aren’t coated of their coverage.

If you would like extra data on SafetyWing, you may as well test them out on Belief Pilot to see unbiased critiques.

General, SafetyWing is a good choice for long-term vacationers and digital nomads if you happen to’re searching for medical protection throughout your adventures overseas.

It’s additionally nice that they’re dedicated to bettering their product providing. So far as journey medical insurance coverage goes, SafetyWing provides an excellent deal for individuals who prefer to bounce round, discover the world, and work remotely and is a good choice as a result of its affordability.

Our Overview: Security Wing Journey Insurance coverage

9.1/10

General, Security Wing is a incredible journey insurance coverage choice for travellers and digital nomads alike. They provide incredible buyer help and fairly complete protection worldwide. It’s a good answer for long-term vacationers and digital nomads as a result of inexpensive month-to-month cost choices and plan flexibility.

Nice customer support

Complete protection

Month-to-month funds

30 day protection your property nation

US protection add on

Excessive deductable charges

Impressed? Pin it!