Maybe you are a cruise lover who needs to spend much less on journey by utilizing factors and miles. Or, possibly you are an avid factors collector seeking to e-book your first cruise trip. Both approach, you are doubtless questioning the best way to leverage your factors stash, bank cards and loyalty standing to get probably the most worth out of your cruise reserving.

You may assume your greatest guess is to save lots of money by booking a cruise using points and miles, however this technique doesn’t all the time yield probably the most advantageous redemption choices. A greater guess could be to make use of your cruise reserving to earn you issues like extra factors and miles, standing and even free onboard perks.

For cruise information, evaluations and suggestions, join TPG’s cruise newsletter.

Right here is our professional recommendation on the simplest methods for maximizing the rewards out of your cruise bookings.

Pay with a journey bank card to earn additional factors and miles

You’ll usually get probably the most out of your cruise reserving by utilizing the expense as a possibility to earn factors and miles towards a future journey, somewhat than by redeeming factors for a free or discounted crusing.

Most often, cruise purchases are coded as a journey expense by your bank card. A very good technique for maximizing your cruise buy is to pay to your crusing with a travel credit card that earns greater than 1% or 1 mile per greenback spent on journey purchases.

As soon as on board, your basic expenses will be covered as a part of your cruise reserving — together with meals in choose eating places and leisure — however there all the time will likely be some alternatives to splurge. You may have to register a bank card along with your cruise ship to pay for drinks and cocktails, meals at one of many fancier eating places on board, shore excursions and spa remedies.

Once more, you may earn probably the most factors in your onboard bills by paying with a bank card that gives additional incentives for a broad vary of journey purchases. Try TPG’s best credit cards for cruises to seek out the one which works for you.

To get you began, here’s a fast reference chart of the present greatest bank cards for basic travel-related bills and their incomes price with TPG’s valuation on journey purchases:

Day by day Publication

Reward your inbox with the TPG Day by day publication

Be a part of over 700,000 readers for breaking information, in-depth guides and unique offers from TPG’s consultants

The data for the American Specific Inexperienced Card and U.S. Financial institution Altitude Reserve Visa Infinite Card has been collected independently by The Factors Man. The cardboard particulars on this web page haven’t been reviewed or supplied by the cardboard issuer.

Earn airline or resort elite standing

A big buy, corresponding to a cruise reserving, can be an effective way to get nearer to airline or resort elite standing in the event you use a cobranded airline or hotel credit card that contributes to your stash of elite-qualifying factors.

For instance, American Airways bases its elite standing on AAdvantage Loyalty Factors accrued by a number of channels, together with purchases made with its cobranded bank card. The Citi® / AAdvantage® Executive World Elite Mastercard® (see rates and fees) earns 1 AAdvantage Loyalty Level per greenback spent. So, by paying for a $10,000 cruise on the cardboard, you’d earn 10,000 Loyalty Factors, 1 / 4 of the 40,000 Loyalty Factors wanted for entry-level AAdvantage Gold status.

Equally, most cobranded United MileagePlus credit cards allow you to earn 25 Premier qualifying factors for each $500 you spend towards the PQP and Premier qualifying flight necessities for United Airlines Premier status. The United Quest Card and the United Club Infinite Card earn 2 miles per greenback and as much as 6,000 and eight,000 PQPs, respectively. So, by paying to your cruise fare on both of those playing cards, you might earn redeemable miles and PQPs towards standing.

Lastly, Delta’s bank cards earn 1 mile per greenback spent on journey purchases, however beginning Jan. 1, 2024, the Delta SkyMiles® Reserve American Express Card and the Delta SkyMiles® Reserve Business American Express Card earn 1 Medallion Qualification Greenback for each $10 spent. As a cardholder, you may earn 2,500 MQDs per calendar 12 months.

On the resort aspect, the World of Hyatt Credit Card earns 2 World of Hyatt factors per greenback spent on journey and two qualifying evening credit towards your subsequent tier standing each time you spend $5,000 in your card. You may additionally earn a Category 1-4 free night certificate in the event you spend $15,000 in a calendar 12 months. A big cruise buy can put you on observe for each of these bonuses.

Additionally, the Marriott Bonvoy Boundless Credit Card earns 2 Marriott Bonvoy factors per greenback spent on journey and an elite-qualifying evening for each $5,000 you spend on the cardboard. Spend $35,000 on the cardboard in a calendar 12 months, and you will obtain Gold Elite status.

Associated: A beginners guide to picking a cruise line

Meet a sign-up bonus

Even in the event you solely earn 1% or 1 mile per greenback spent on journey purchases, you may nonetheless use your cruise fare to earn a welcome bonus. In case you have an enormous cruise expense arising, take into account making use of for a brand new bank card so your fee not solely earns you redeemable factors but in addition helps to satisfy the minimal spend requirement to earn the massive welcome bonus.

As a brand new cardholder of The Platinum Card® from American Express, for instance, you may earn 80,000 factors (value $1,600 at TPG’s valuations) after you spend $8,000 in eligible purchases in your card throughout the first six months of card membership. One high-end cruise may get you all the way in which to that bonus with one buy.

Consult with this post for the perfect bank card provides presently obtainable.

Last fee is often due three months previous to crusing, so that you may have the ability to meet the spend minimal and obtain the welcome bonus cut-off dates to e-book flights or motels for journey earlier than or after your cruise. (Alternatively, you might pay the complete cruise fare early.) This lets you leverage your factors for added journey bills that may in any other case require out-of-pocket bills.

Or, it can save you these factors to make use of on flights and motels for a subsequent cruise or trip.

Associated: Last-minute cruises: Should you book the deal?

Get additional cruise perks by bank card provides

Reserving a cruise with the suitable bank card can earn you greater than factors. Once you e-book by your bank card’s portal, you may additionally be eligible for additional perks or reductions in your trip at sea.

In case you have The Platinum Card® from American Express, you are eligible for added perks and advantages underneath the Amex Cruise Privileges Program.

Whether or not you pay in money or use your Membership Rewards factors to defray your cruise bills, you may obtain as much as $300 in cabin credit score on cruise strains corresponding to Norwegian Cruise Line, Holland America Line, Princess Cruises and Royal Caribbean International.

Extra Amex Platinum perks differ by cruise line. Whereas Amex would not usually publish its official advantages, reviews point out that earlier advantages included a $200 shore tour credit score on Crystal and a bottle of premium Champagne or wine on Royal Caribbean.

Moreover, American Express ceaselessly offers rewarding Amex Offers on cruises. Earlier this 12 months, as an illustration, Amex provided a bonus of 20,000 Membership Rewards points once you spent $1,000 or extra on a Royal Caribbean voyage.

The variety of bonus factors, 20,000, is kind of substantial. With our present valuation of Membership Rewards factors at 2 cents apiece, these 20,000 factors could be value $400 based mostly on our analysis. Which means in the event you use an American Specific card to spend $1,000 on a Royal Caribbean cruise, you obtain 40% of that quantity again in Membership Rewards factors.

It is value noting that these provides are focused, which means they don’t seem to be obtainable to each cardholder. Moreover, you will need to enroll within the particular Amex Provide to make the most of it.

There are just a few different concerns as nicely. Cardmembers can solely enroll within the supply utilizing one American Specific card, and it’s important to assessment and cling to the phrases and situations to obtain the bonus factors.

I lately booked a Movie star Cruise once I was provided a 35,000-point bonus for spending $1,000 on my American Express® Gold Card. Since my mother had the identical supply on her Amex Gold, I known as Movie star to separate the fee for the cruise between the 2 playing cards. To get 72,000 Amex factors for a $2,000 cruise is a incredible maximization technique.

Different bank cards do not supply cruisers practically as many perks because the Amex Platinum does. Nonetheless, the Chase Sapphire Reserve does supply an annual $300 assertion credit score towards any travel-related buy, together with cruise bookings, made by its reserving portal.

Ebook cruises through an airline portal for additional miles

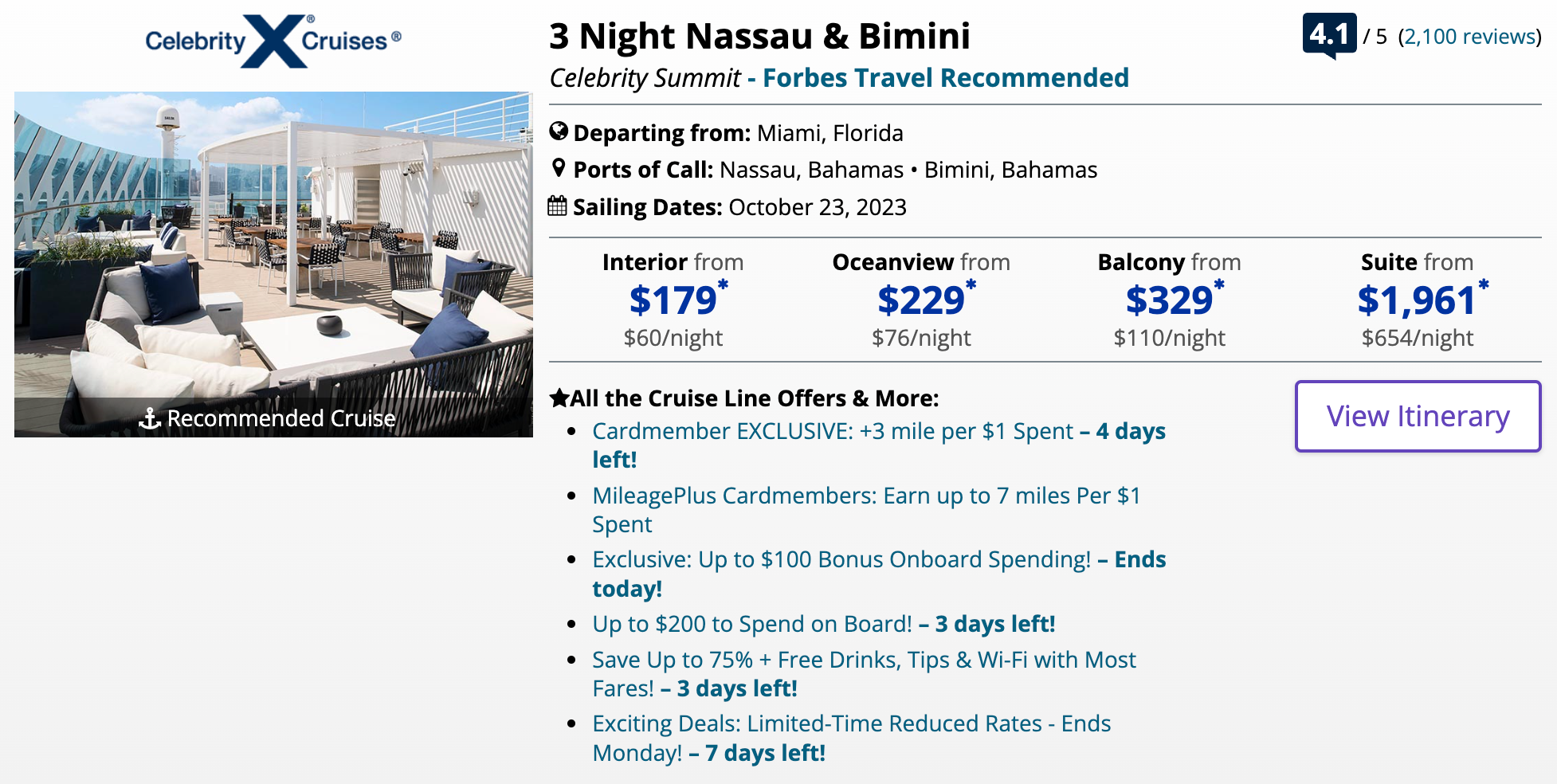

A number of airways can help you earn bonus miles by reserving cruises through their web sites. Airline-affiliated on-line cruise sellers embody United Cruises, American Airlines Cruises and Delta SkyMiles Cruises.

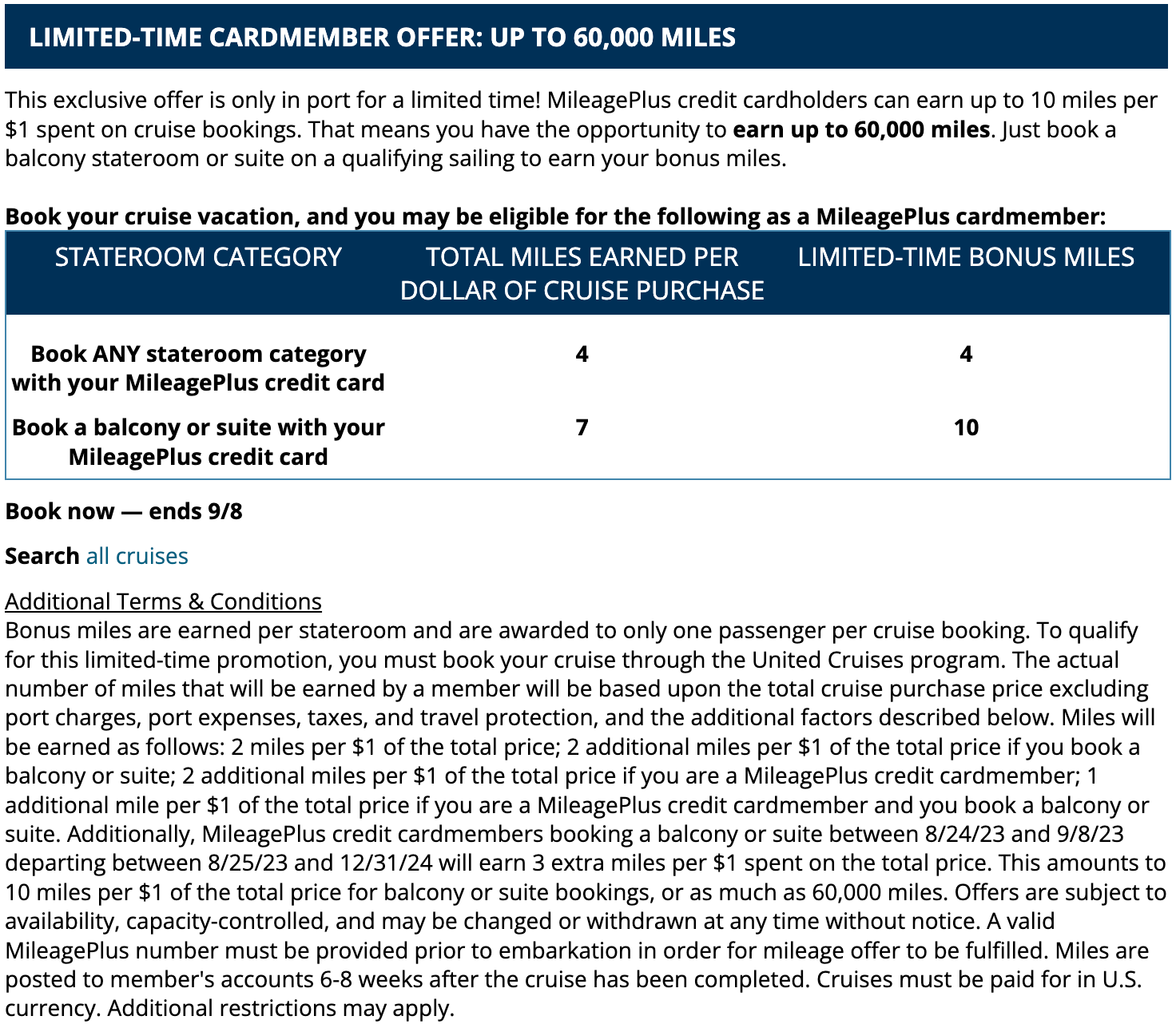

The cruises we priced out through United Cruises had been largely the identical worth as reserving straight with the cruise strains. The one distinction is that you’d earn bonus United miles per greenback spent for reserving through the United website.

On our Royal Caribbean cruise reserving take a look at, United bank card holders can earn up to 10 miles per dollar spent on the cruise cabin’s base price for reserving through the airline’s cruise portal. These elevated accruals are just for balcony and suite rooms. Your United Cruises earnings are capped at 60,000 MileagePlus miles per buy, and there is a one-time bonus of two,500 miles per cruise reserving.

You may additionally earn 1 or 2 miles per greenback extra by paying for the cruise in your cobranded United MileagePlus credit card. Or, double dip by paying with any bank card that offers you additional factors for journey purchases.

Do not forget that these bookings are thought-about third-party purchases, so cruise strains will not be obligated or may not be inclined to can help you make adjustments.

For this Movie star crusing for a household of two, that might imply selecting up 6,580 United MileagePlus miles, valued by TPG at round $95.

Plus, vacationers with United elite standing obtain extra onboard perks when reserving by United Cruises. Bonuses differ by cruise line and are based mostly in your elite standing tier, however you might get something from stress-free spa remedies to complimentary wine to as much as $300 to spend on board.

Associated: Get up to 200,000 AAdvantage bonus miles with this limited-time cruise offer

Use on line casino loyalty to get perks and free cruises

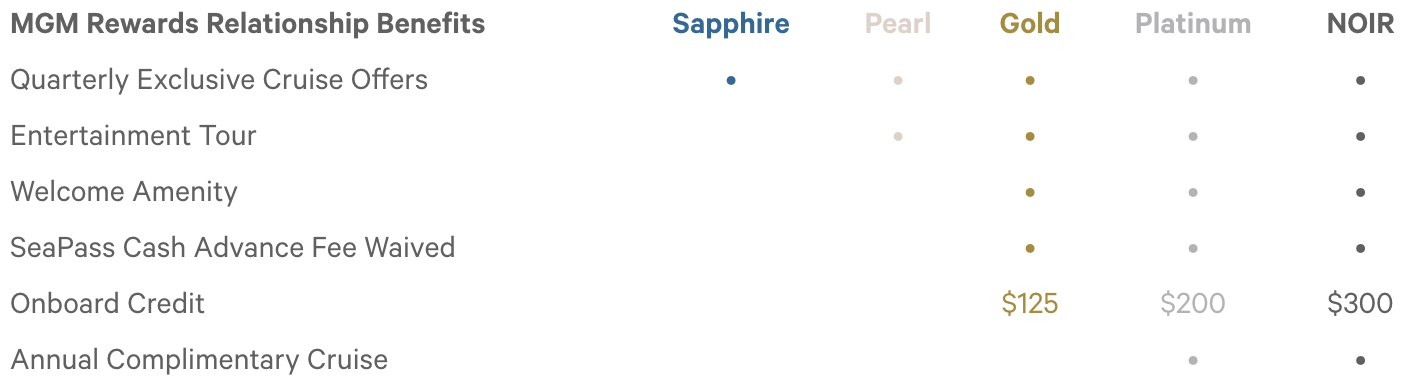

Your on line casino loyalty standing also can earn you cruise perks. In case you have standing with MGM Rewards, for instance, you might need entry to cruise perks and even free cruises.

Gold members and above are eligible for onboard credit score on Royal Caribbean or Celebrity Cruises, plus a welcome amenity and an leisure tour. You have to to validate your loyalty standing with the cruise line previous to departure to entry your perks.

Even higher, when you hit Platinum standing with MGM, you may e-book one free cruise yearly with both of the sister cruise strains. To e-book your free cruise, you may have to contact the MGM Rewards elite reservations division.

The phrases point out that you must earn Platinum or Noir status by gameplay to get the free cruise.

Associated: 13 best all-inclusive cruise lines

Leverage Marriott’s cruise partnership to earn factors and standing

Most cruise strains have their very own loyalty applications which are solely centered on onboard perks when crusing that line. Nonetheless, one cruise line is linked to a resort loyalty program, so a direct reserving will earn you factors usable outdoors the cruise world.

The Ritz-Carlton Yacht Collection participates within the Marriott Bonvoy loyalty program. This enables members to earn and redeem factors on Ritz-Carlton cruises and luxuriate in numerous perks related to elite standing throughout their voyages.

When reserving by The Ritz-Carlton Yacht Assortment, you’ll earn 5 Marriott Bonvoy factors for each greenback spent on the cruise fare. Your cruise fare will contribute towards the $23,000 spending requirement for Marriott’s Ambassador Elite status. Moreover, you’ll earn elite nights to your cruises.

Purchase cruise present playing cards strategically to earn extra factors

You should utilize bank cards strategically to maximise earnings in your cruise purchases, past additional factors for journey purchases. A technique is by buying present playing cards.

Some cruise strains supply present playing cards on the market at retailers corresponding to grocery shops and workplace provide shops. Relying on which bank cards are in your pockets, you may have the ability to earn more points per dollar when picking up cruise (or Disney) gift cards.

For instance, with a card just like the American Express® Gold Card, you may earn 4 factors per greenback spent at groceries at U.S. supermarkets, as much as $25,000 in a calendar 12 months. Use this card to buy cruise present playing cards at your most well-liked grocery retailer, and you’ll successfully categorize your cruise bills as grocery purchases. On this approach, you may accumulate extra bank card factors than in the event you paid to your cruise buy with a card that solely provides double factors for journey purchases.

Associated: A beginners guide to cruise line loyalty programs

Backside line

Paying for a cruise is usually a important buy. You may positively need to get probably the most bang to your buck in factors, miles, standing development or perks once you pay that invoice.

When it is time to plan your subsequent cruise, select the technique or methods that make sense based mostly on the bank cards and loyalty standing you’ve (or want to have). Even in the event you’re not getting a free cruise this time round, good spending choices will maximize the worth you get from this buy to low cost or ease your journey sooner or later.

Planning a cruise? Begin with these tales:

For charges and costs of the Amex Platinum Card, click on here