Sending and receiving overseas forex was my greatest headache. On this Clever assessment (previously TransferWise), I’m going to point out you precisely why it’s now a complexity of the previous.

After I was working and traveling in Australia, paying payments and sending a reimbursement dwelling was practically inconceivable. My wages had been going right into a overseas account, however I couldn’t use my overseas card to pay payments in the US.

I couldn’t discover a sensible method to switch the cash between my accounts, and even to ship cash to my household and buddies again dwelling.

I attempted transferring cash from my overseas account to my US account through financial institution wire, however I used to be getting charged $35 each single time.

I attempted utilizing PayPal with a number of accounts hooked as much as totally different playing cards in several nations—which was clunky at finest—and I nonetheless needed to take care of their felony alternate fee.

And Western Union not solely took days however they charged one thing like $50-$100.

Clever Assessment

Like many expats and long-term vacationers, I used to be on the opposite facet of the world with no method to ship, obtain or switch cash at an inexpensive fee. The banks had me locked out. It ought to have been really easy, nevertheless it wasn’t.

As a substitute, I watched the banks take lots of of {dollars} in charges whereas I labored my ass off to afford my travels.

I first heard about Wise final yr and I now use it to ship cash to buddies, to pay payments overseas, and even to simply accept funds from my worldwide shoppers. I ship and obtain cash everywhere in the world, to and from any account, in any forex, on the official conversion fee, for a flat charge of about 1%.

It’s virtually revolutionary. And on this Clever assessment, I’m going to let you know why that is the easiest way to ship cash overseas, bar none.

What’s Clever, Anyway?

Wise was launched in 2011 as TransferWise, and has been backed by Peter Thiel (co-founder of PayPal, board of Fb, an investor in Airbnb and Stripe) and Richard Branson (Virgin Airways, Virgin Information, Virgin all the things).

It’s made by two Estonian fellas: Kristo Käärmannone, monetary guide, and Taavet Hinrikus, the first ever employee at Skype. They’ve obtained some critical road cred, and with $117 million in funding, they’ve obtained the cash behind them to make Clever a family identify.

It’s my hope that, by using Wise, you’ll have the ability to spend much less on the financial institution and extra in your travels.

How Does Clever Work (and Why Is It So Low-cost)?

Historically, sending cash has concerned a intermediary—the financial institution. You give the cash to them, they convert it, take their fee, then ship it to the recipient.

However with Wise you alternate forex with different prospects.

That is the cool half: Clever operates like a peer-to-peer service. Reasonably than exchanging cash with the financial institution, you alternate cash with a peer—another person who additionally desires to make use of Clever to ship cash abroad. It cuts out all of the charges (and it’s completely safe).

For example, let’s say I wish to ship $200 to a good friend in Germany. In Germany, a man named Markus is sending €200 to a good friend within the States. Primarily, we’re making the identical transaction, however backward and in reserve. As a substitute of truly changing our money, we simply swap cash.

Fairly neat, huh? Technically, your cash by no means even crosses a border, which is why they don’t need to cost you for the conversion.

Clever Assessment: Totally different Methods to Use the Service

The issue with some huge cash switch companies is that they solely do one factor—they switch cash. Wise, nevertheless, is surprisingly versatile. Listed here are a couple of examples of how I’ve used them up to now:

1. Transferring Cash Between Accounts – Since I’ve financial institution accounts in a number of nations, I take advantage of Clever to switch cash between them. All I’ve to do is enter the financial institution particulars of every one and Clever initiates the switch at the true conversion fee, solely charging a minimal charge.

2. Paying Payments Overseas – Clever makes it simple to pay payments from abroad, irrespective of which nation you’re in. Simply enter the enterprise data and their financial institution data/IBAN quantity they usually care for the remainder.

3. Sending Cash to Associates – Final yr after I was in Bangkok, my good friend Ben misplaced his financial institution card. Since he didn’t have any cash on him, he logged on-line and despatched me €400 with Clever. He paid €4 in charges, and I acquired the precise quantity in my checking account in US {dollars} (inside 24 hours and on the official alternate fee). I then withdrew Thai baht on the ATM and Ben may lastly afford his dinner as soon as once more (although I clearly lent him sufficient to pay for dinner and some beers within the meantime).

4. Invoicing Freelance Purchasers – As a blogger, I do enterprise with shoppers everywhere in the world. I’ve discovered worldwide wire transfers to be one among three issues: expensive, complicated, or unreliable. With Clever, I can ship a easy cash request to a shopper, who then initiates a typical financial institution switch to Clever.

As a result of Clever has a checking account in every nation, it’s technically an area switch for the shopper and an area switch for me, so they cost simply 1%. One of the best half is that my shoppers don’t even have to join an account, and neither one among us has to pay massive charges! It’s all quite simple.

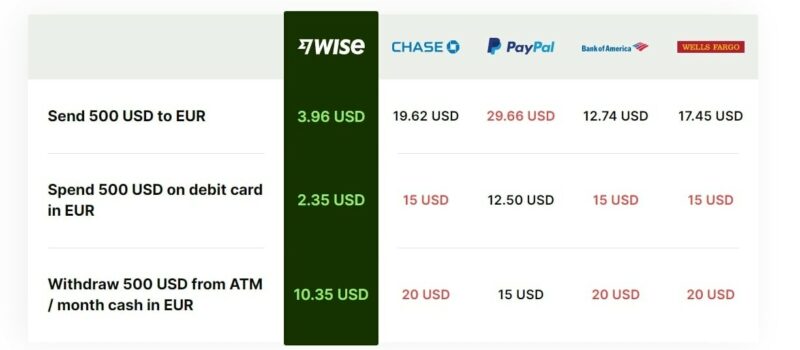

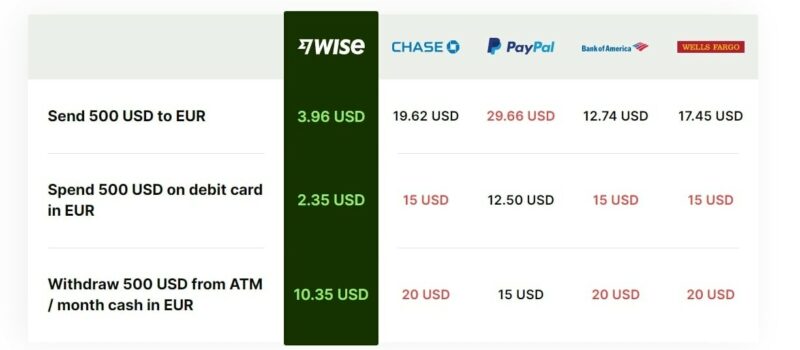

Clever vs. PayPal vs. The Financial institution

For years, PayPal has been the massive participant on the subject of sending and receiving cash on-line. Since lots of people have a PayPal account nowadays, it’s the go-to choice as a result of it’s simply plain simple. However is comfort value paying 6.9%?

Not solely do they cost about 3.9% to ship cash, however they cost you an additional 3% on high of their already felony alternate fee. Upon getting the cash in your account, they pressure you to transform the forex with them. It’s locked in your PayPal account and you may’t withdraw it except you use their conversion charges.

Sneaky buggers.

I’ll be trustworthy, I was an enormous fan of PayPal, however I’ve come to despise them. For a very long time they’ve been the one choice, and even in the present day I’m pressured to make use of them quite a bit to run my enterprise—they’re a mandatory evil. I used to be actually excited to seek out Wise as a result of it means I can part PayPal out of my life.

The opposite issue with PayPal is that, if you wish to switch cash between your personal banks, you may have to join a number of accounts. Because you’re solely permitted to have one PayPal account per nation, it’s a must to log out and in a number of instances, and also you’re nonetheless caught paying the extreme alternate fee.

With Clever, you pay about 1% per switch. So if I ship $1,000, the charge is about $10. With Paypal, it will price $69. Utilizing an worldwide financial institution switch, sending $1,000 may price as much as $100 in charges. It’s type of a no brainer.

So What’s the Catch with Clever?

That was my first query, too. I’m so used to getting cheated by banks that I couldn’t perceive why an organization would cost cheap charges. It’s the peer-to-peer performance that makes Clever low-cost (to not point out it’s actually intelligent). Reasonably than having to consistently convert forex, Clever is matching up customers from around the globe, and it’s completely safe.

Realistically you don’t see something that occurs behind the scenes. I’m not looking for a man named Markus to make an alternate with. Clever has an enormous pot of cash to attract from in every nation, so you don’t have to fret about ready for another person to make a switch, too. The platform is ready as much as function like a standard cash switch service—simply enter the recipient and the quantity, and press ship.

And right here’s one thing else: in most main currencies, Clever lets you ship cash utilizing your bank card because the funding supply. And all they cost is 1%!

That positively beats PayPal’s 6.9% and the financial institution’s hefty lower.

READ NEXT: