The worldwide aircraft market is dealing with a difficult state of affairs attributable to manufacturing points in engines and plane throughout varied Original Equipment Manufacturers (OEMs). In keeping with ICICI Securities, it’s anticipated that the restoration in plane provide can be delayed attributable to recent points being mentioned in each Boeing and Airbus.

Up to now, the plane provide fashions haven’t been very efficient for India attributable to OEM points and weak airline stability sheets, which has led to a virtually stagnant fleet of round 650-700 plane in India for the final 4 years. Regardless of any seasonal weak point, ICICI Securities believes that the provision scarcity will assist profitability, and it stays their funding thesis on InterGlobe Aviation (IndiGo).

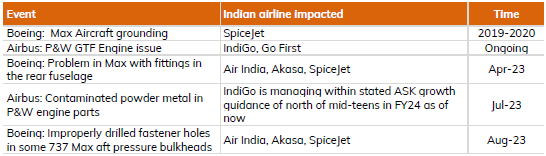

Though plane technical issues have turn into extra manageable, the grounding of B737 Max worldwide and different incremental points have led to challenges for Boeing, reminiscent of fittings in aft fuselage and improperly drilled fastener holes in a element that helps preserve cabin stress. For Airbus, there have been P&W GTF engine issues, adopted by a recent inspection of contaminated powder steel in a number of the engines.

The impression of those points will proceed to have an effect on deliveries and postpone deliberate supply schedules, as indicated by all OEMs, together with Boeing, Airbus, and Embraer.

One doable angle to contemplate relating to these plane points is the extreme outsourcing and price administration in direction of aeroplane half producers and the relative deserves/demerits of vertical or spread-out provide chains. Such debates may make clear the structural elements of the present issues within the plane market.