Posted: 7/31/23 | July thirty first, 2023

Journey insurance coverage isn’t an thrilling subject to analysis. Once you’re planning a visit, the very last thing you need to do is examine insurance policies about theft and accidents that may happen overseas.

However, as I’ve said before, when an emergency strikes, it’s higher to be secure than sorry.

Whether or not you’re touring for 2 weeks or two months, shopping for journey insurance coverage is a should.

However what occurs while you’re gone for 2 years, not simply two months?

In that case, you want extra than simply emergency protection. You want well being care. You want protection for routine and preventive check-ups and prescribed drugs, in addition to for damaged limbs and misplaced baggage.

Created by SafetyWing, Nomad Well being is international medical health insurance protection for distant staff, expats, and nomads.

It’s each emergency journey insurance coverage and medical insurance coverage whilst you’re away. It’s tremendous inexpensive, making it a recreation changer for long-term vacationers, digital nomads, and people residing overseas.

Right here’s all the things you might want to find out about Nomad Well being to resolve if it’s best for you and your journey plans.

What’s Nomad Well being?

Nomad Health is insurance coverage for digital nomads, distant staff, and long-term vacationers. It’s a mixture of your normal emergency protection that every one journey insurance coverage provide, together with “common” well being care protection, reminiscent of routine visits and preventive care.

It’s a reproduction of the sort of medical health insurance you would possibly discover in your house nation, making certain that you simply’re taken care of it doesn’t matter what occurs.

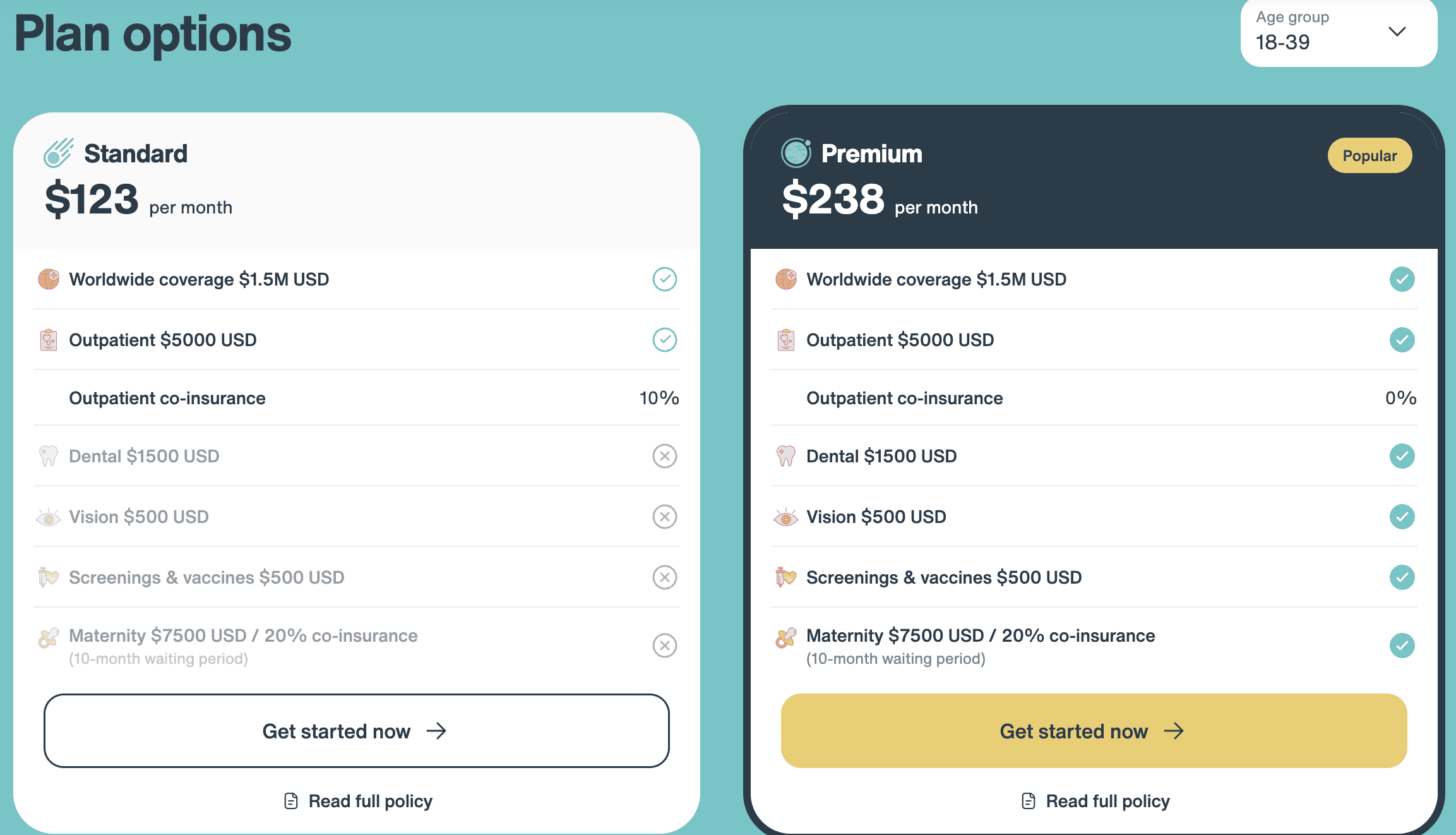

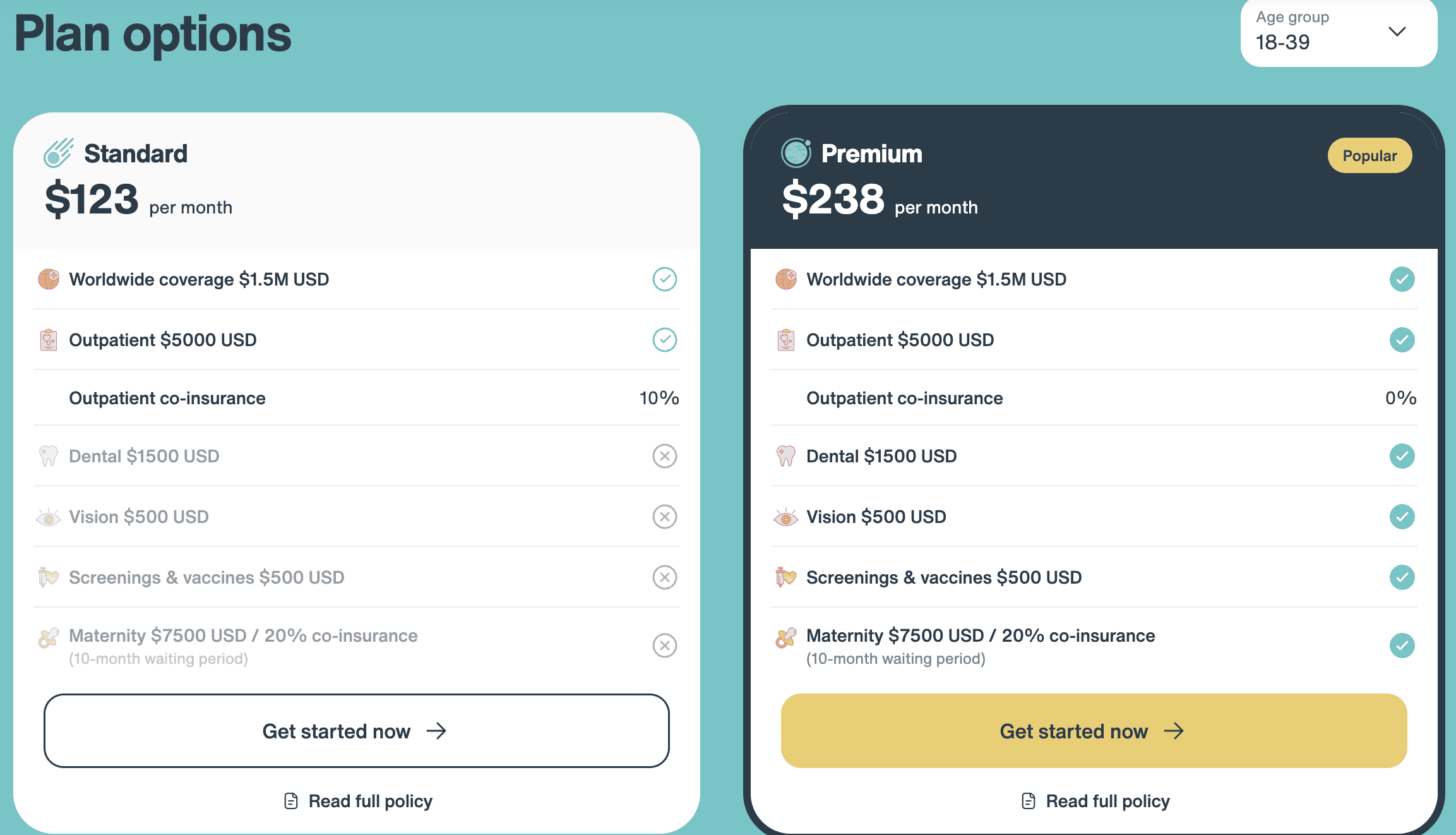

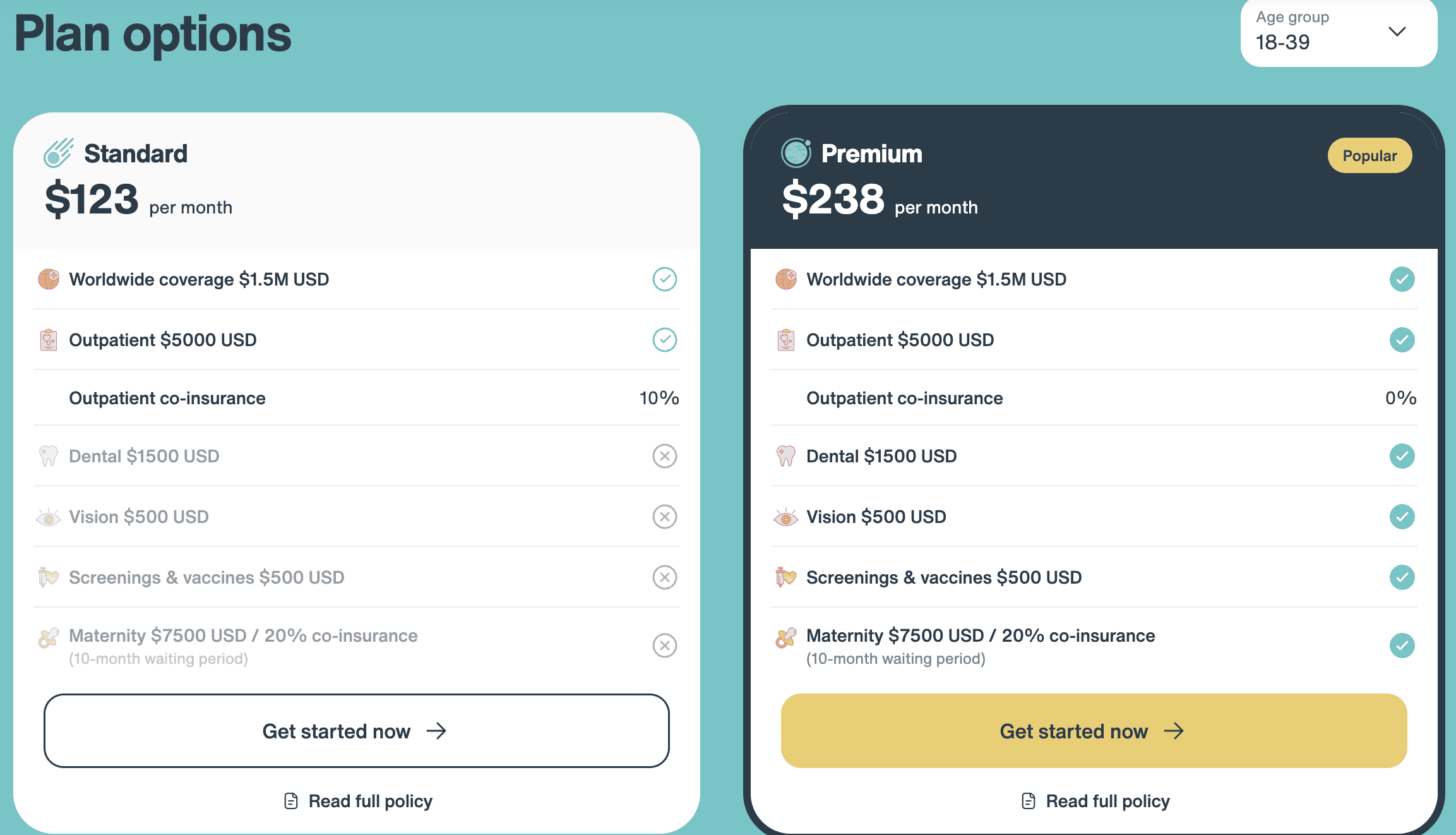

Presently, there are two tiers: Customary and Premium. The principle variations (as you possibly can see within the picture beneath) is that Premium gives larger protection: dental as much as $1,500 USD, imaginative and prescient as much as $500 USD, vaccines as much as $500 USD, and maternity prices as much as $7,500 USD.

You possibly can study extra and examine the plans here.

How is Nomad Well being Totally different from Common SafetyWing Protection?

Journey insurance coverage must be regarded as “emergency insurance coverage.” In case you break a leg or lose a bag or get caught in a hurricane, journey insurance coverage may help.

Nomad Well being, nevertheless, covers each emergencies and common medical care. Which means you may get assist — and get reimbursed — for emergency and non-emergency occasions.

There are just a few different variations to notice when evaluating Nomad Well being with SafetyWing’s normal journey insurance coverage (known as Nomad Insurance coverage):

- Nomad Heath covers these as much as age 74 (vs. 69 for Nomad Insurance coverage)

- There isn’t any deductible with Nomad Well being (it’s $250 USD with Nomad Insurance coverage)

- Claims are dealt with in 10 days (as a substitute of 45 with Nomad Insurance coverage)

- Protection for one’s residence nation is included (that prices further with Nomad Insurance coverage)

One other essential distinction is that, not like for normal journey insurance coverage, Nomad Well being candidates must be authorised. You possibly can’t simply purchase a plan and be in your merry manner, because the insurance coverage staff must overview your utility, together with any medical historical past and/or pre-existing circumstances. They could additionally request further medical notes or paperwork.

Moreover, pre-existing circumstances will not be coated, and there are some candidates that won’t be capable to be coated. (Pre-existing circumstances are not often coated underneath common journey insurance coverage.)

I don’t love that some individuals are prone to be screened out, however I perceive it given the price of well being care world wide. I believe, since this was simply rolled out, that as issues progress and the pool of candidates will increase and the corporate sees how this works, they’ll open it as much as increasingly individuals.

Who’s Nomad Well being For?

In case you’re heading out on a visit for just a few weeks or just a few months, Nomad Well being isn’t for you. Common journey insurance coverage (like SafetyWing’s Nomad Insurance) will greater than suffice.

However in the event you’re going to be away for a 12 months or extra and need to be sure to have appropriate well being protection for each accidents and routine care, then Nomad Well being is for you.

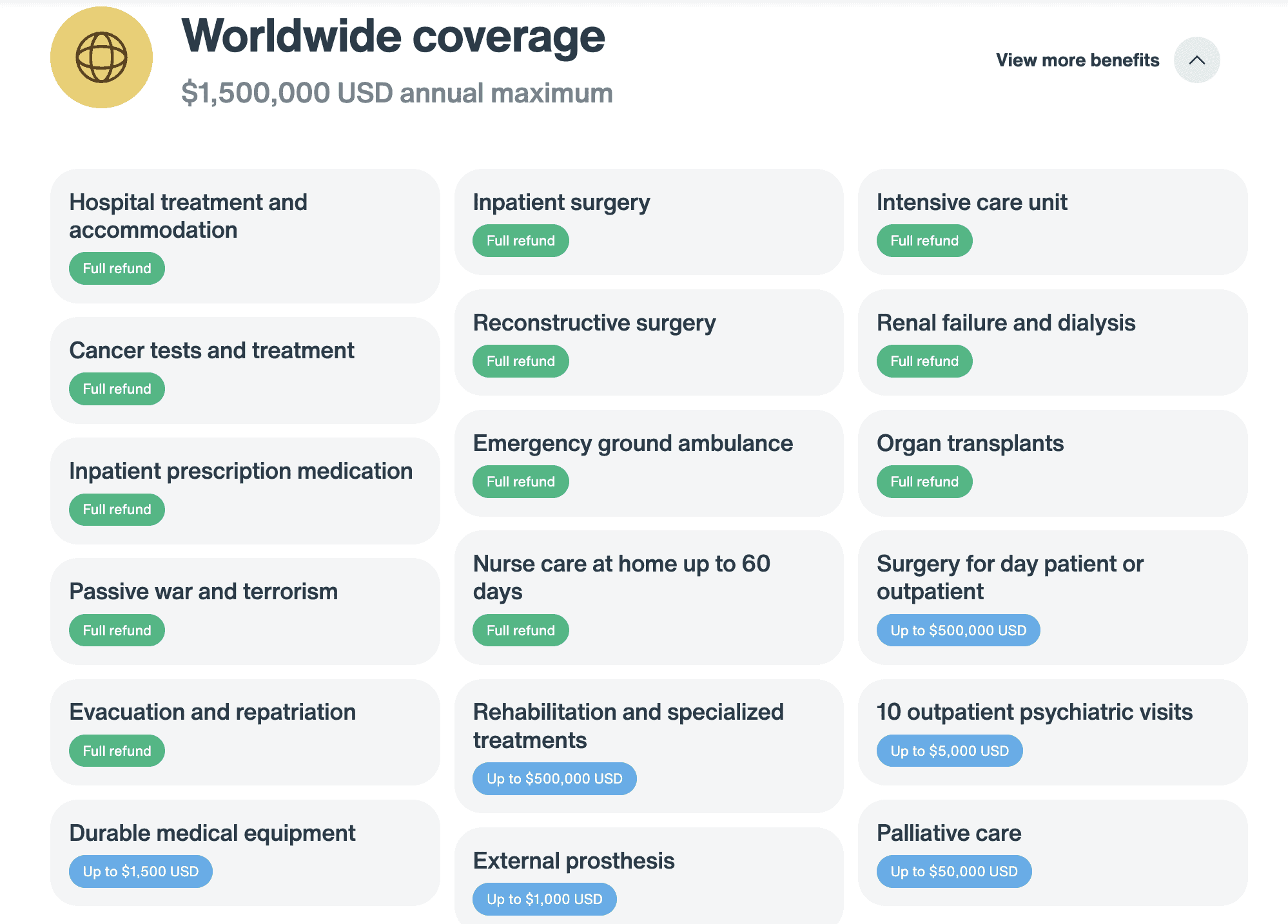

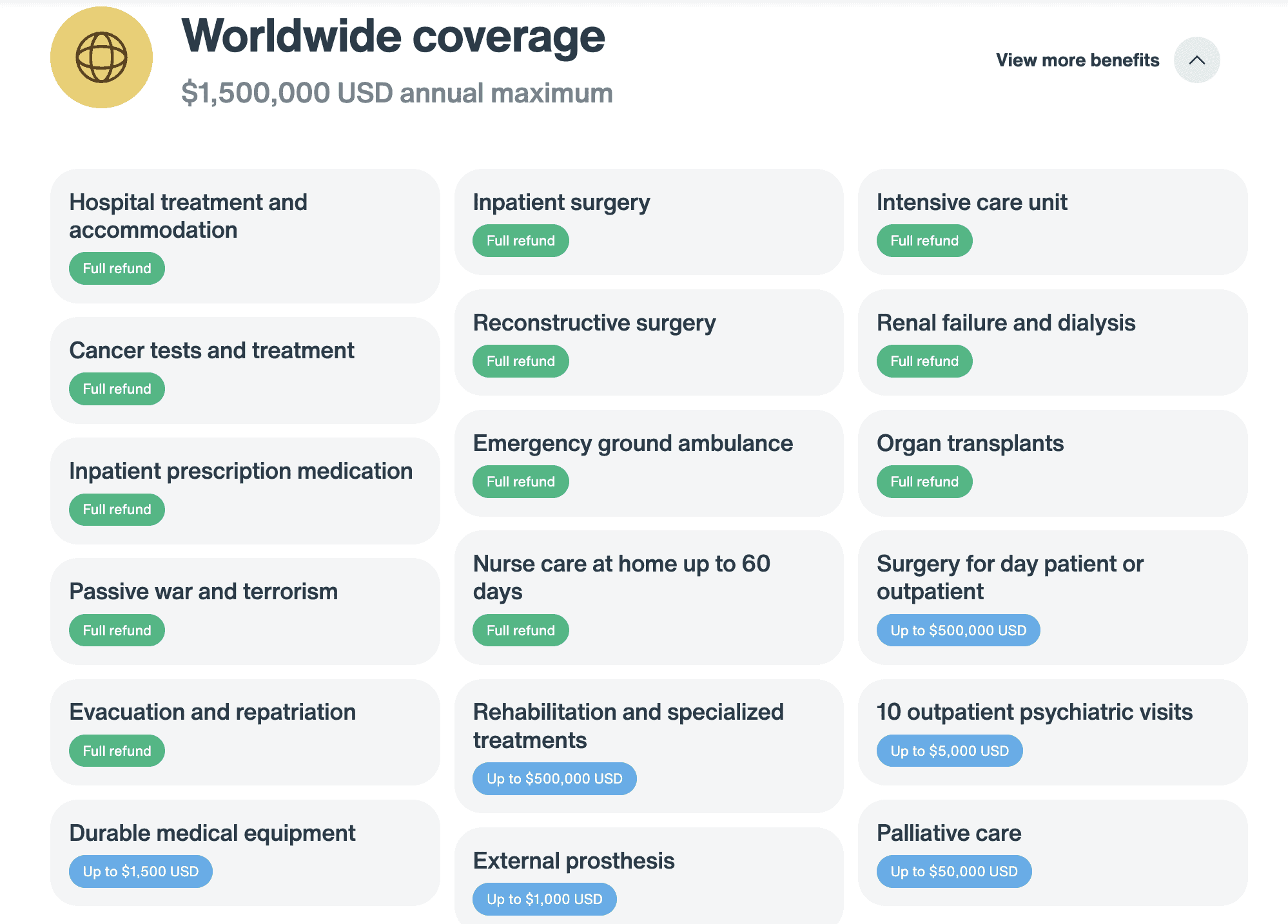

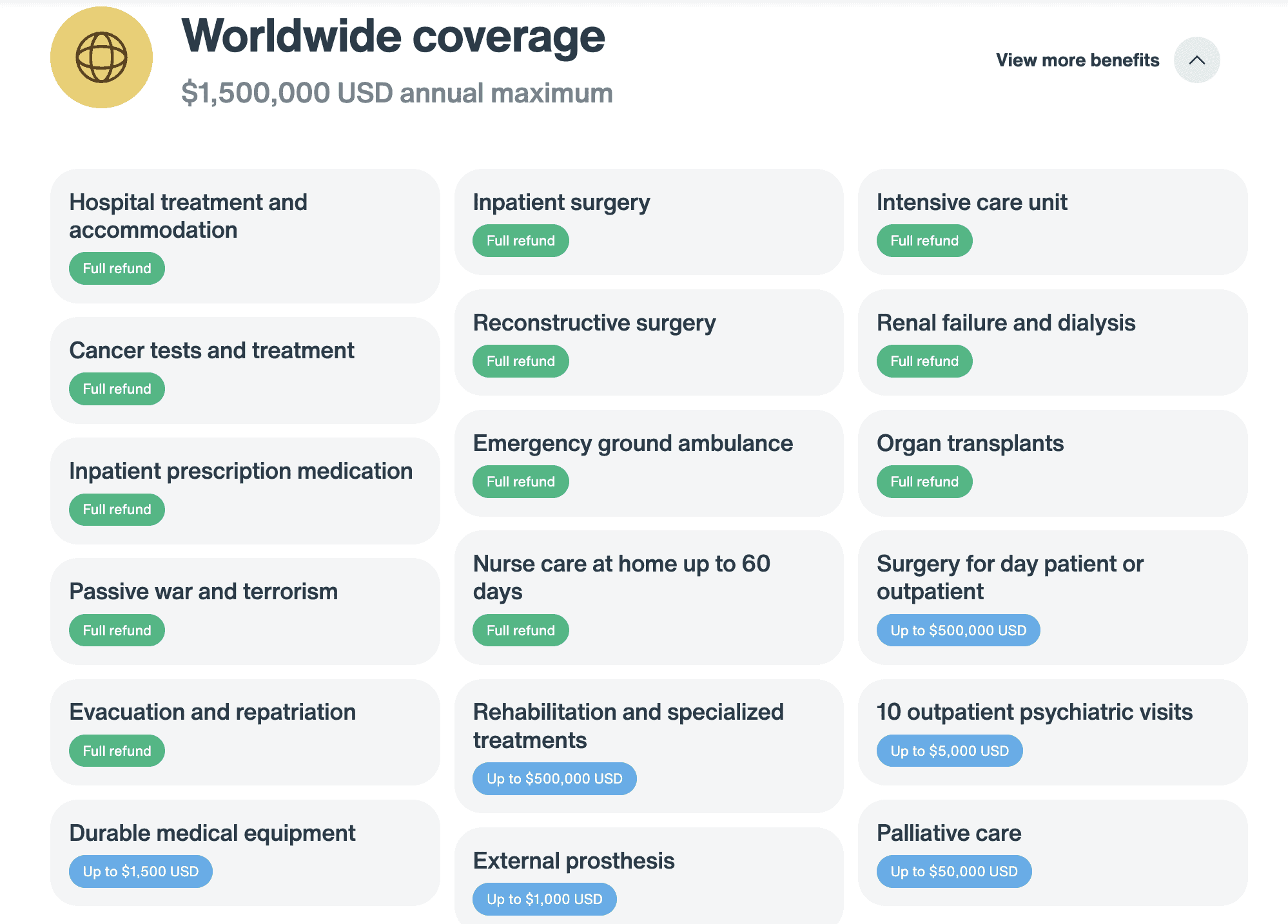

In brief, in the event you’re a digital nomad, expat, or long-term traveler, that is the plan I’d suggest for you. Right here’s a take a look at what is roofed:

Crucial quantity right here is that $1,500,000 USD. Vacationers utilizing Nomad Well being get $1.5 million in protection every year, which is greater than sufficient for just about something. Most traditional journey insurance coverage cowl only a couple hundred thousand {dollars}, in order that $1.5 million casts a large security web and goes a good distance to make sure you’re coated it doesn’t matter what occurs.

How A lot is Nomad Well being?

In case you’re 18-39, a Standard Nomad Health plan prices round $123 USD monthly. For a Premium Plan, that very same traveler can pay $238 USD monthly.

Costs go up per age group (similar to with any insurance coverage), so the best month-to-month payment is for vacationers aged 60-74, which prices $537 USD monthly for the Customary Plan. Once more, whereas that looks like lots, it’s less expensive than most different choices on the market — and less expensive than paying out of pocket.

To see how a lot a plan will value for you, click here to get a free quote.

After I began backpacking, journey insurance coverage choices have been restricted. And costly. Luckily, we’ve got much more choices lately — with lots higher protection. If I used to be beginning out once more, heading off on one other 18-month journey world wide, Nomad Health is precisely the sort of plan I’d get. It covers the fundamentals in addition to emergencies, and can be tremendous inexpensive.

I do know insurance coverage looks like an pointless added value, however I’ve realized the exhausting manner — a number of instances — that it’s an expense price paying for.

Don’t be low cost together with your well being. Keep coated and keep secure. You gained’t remorse it.

Ebook Your Journey: Logistical Ideas and Methods

Ebook Your Flight

Discover a low cost flight by utilizing Skyscanner. It’s my favourite search engine as a result of it searches web sites and airways across the globe so that you at all times know no stone is being left unturned.

Ebook Your Lodging

You possibly can e-book your hostel with Hostelworld. If you wish to keep someplace aside from a hostel, use Booking.com because it persistently returns the most affordable charges for guesthouses and resorts.

Don’t Neglect Journey Insurance coverage

Journey insurance coverage is one factor you WILL need to purchase. It’s there in the event you get sick, robbed, delayed, or a visit cancelled. I by no means go on a visit with out it since you by no means know what may occur. Don’t skip it. I’ve seen too many vacationers remorse doing so. My favourite corporations are:

Wish to Journey for Free?

Journey bank cards will let you earn factors that may be redeemed at no cost flights and lodging — all with none further spending. Take a look at my guide to picking the right card to get began. For US residents, here’s how you can get points on rent too.

Able to Ebook Your Journey?

Take a look at my resource page for the perfect corporations to make use of while you journey. I checklist all those I take advantage of after I journey. They’re the perfect in school and you’ll’t go unsuitable utilizing them in your journey.